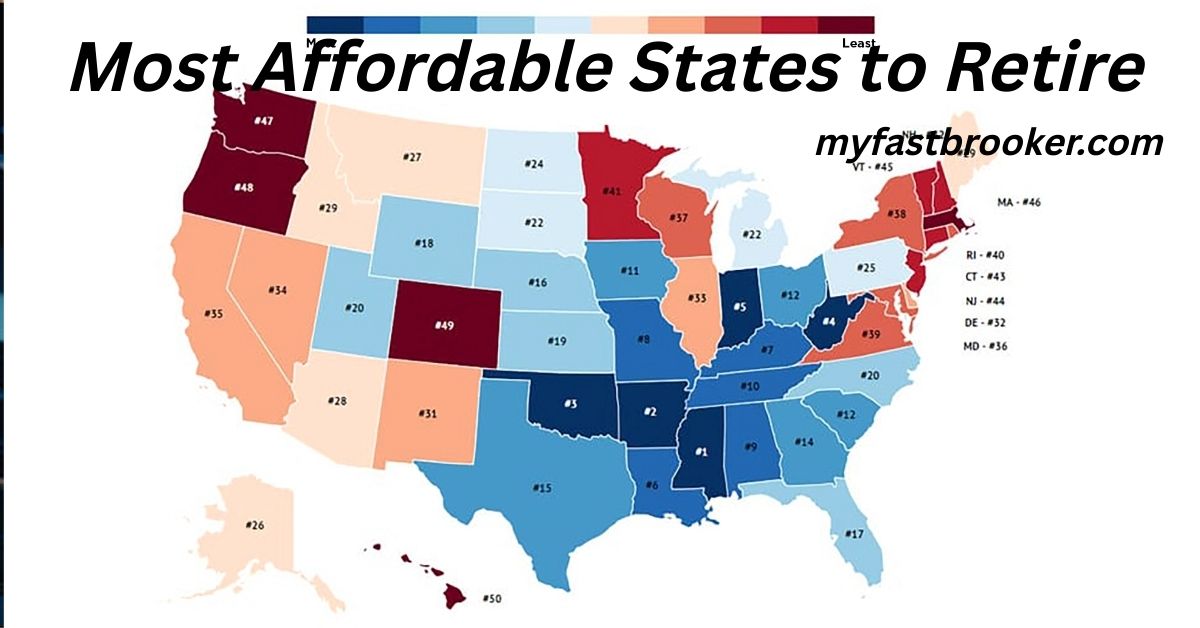

Retirement is a significant milestone, and choosing the right place to spend your golden years is crucial. For many, affordability is a primary concern. In 2025, several U.S. states offer a combination of low living costs, favorable tax policies, and quality healthcare, making them ideal for retirees. This guide delves into the most affordable states to retire, providing insights to help you make an informed decision.

🏆 Top 10 Most Affordable States to Retire in 2025

1. West Virginia

West Virginia stands out as the most affordable state for retirees. The cost of living is significantly below the national average, and the state offers tax exemptions on Social Security benefits. However, healthcare access can be limited in rural areas, so it’s essential to consider proximity to medical facilities.

2. Mississippi

Mississippi boasts low housing costs and affordable healthcare. The state’s tax policies are also favorable, with exemptions on Social Security benefits and low property taxes. The overall cost of living is among the lowest in the nation.

3. Arkansas

Arkansas offers a low cost of living, with affordable housing and healthcare. The state provides tax exemptions on Social Security benefits and has low property taxes. However, healthcare access can vary, so it’s advisable to research local facilities.

4. Missouri

Missouri combines affordable housing with low healthcare costs. The state’s tax policies are favorable for retirees, with exemptions on Social Security benefits. However, healthcare access can vary, so it’s essential to consider local facilities.

5. Tennessee

Tennessee is known for its low cost of living and favorable tax policies. The state has no state income tax, making it attractive for retirees. Housing costs are reasonable, and healthcare facilities are widely available.

6. South Carolina

South Carolina offers a mild climate and a low cost of living. The state provides tax exemptions on Social Security benefits and has low property taxes. Healthcare facilities are widely available, making it a popular choice for retirees.

7. Georgia

Georgia combines affordable housing with a low cost of living. The state’s tax policies are favorable for retirees, with exemptions on Social Security benefits. Healthcare facilities are widely available, making it an attractive option for retirees.

8. Alabama

Alabama offers a low cost of living, with affordable housing and healthcare. The state provides tax exemptions on Social Security benefits and has low property taxes. However, healthcare access can vary, so it’s advisable to research local facilities.

9. Indiana

Indiana boasts low housing costs and affordable healthcare. The state’s tax policies are favorable for retirees, with exemptions on Social Security benefits. However, healthcare access can vary, so it’s essential to consider local facilities.

10. Ohio

Ohio offers a low cost of living, with affordable housing and healthcare. The state’s tax policies are favorable for retirees, with exemptions on Social Security benefits. Healthcare facilities are widely available, making it an attractive option for retirees.

🔍 Key Factors to Consider When Choosing a Retirement State

When evaluating potential states for retirement, consider the following factors:

- Cost of Living: Ensure that housing, utilities, and groceries fit within your budget.

- Tax Policies: Look for states that offer tax exemptions on Social Security benefits and have low property taxes.

- Healthcare Access: Proximity to quality healthcare facilities is crucial.

- Climate: Consider the climate and whether it suits your preferences.

- Community and Lifestyle: Look for states with active communities and amenities that align with your interests.

🌞 Climate Considerations: How Weather Affects Retirement Choices

The climate plays a significant role in your comfort during retirement. States like Florida, Texas, and Arizona are well-known for their warm climates, making them popular choices for those who prefer sunny weather. However, it’s essential to consider the impact of extreme weather, such as hurricanes or scorching summer temperatures, especially in places like Florida and Arizona.

On the other hand, states like South Carolina, Tennessee, and Georgia offer milder climates that balance warm weather with more moderate conditions, ideal for retirees who don’t want to experience the extremes of hot or cold weather.

🏥 Healthcare and Medical Access for Retirees

When choosing the most affordable states to retire, access to healthcare is one of the most important factors to consider. Retirees often have specific health needs, and states with more extensive healthcare infrastructure can be crucial.

- South Carolina: South Carolina has an abundance of healthcare facilities, with top hospitals and medical centers across the state, making it a prime choice for retirees.

- Georgia: Georgia offers various healthcare providers with excellent reputations, especially in larger cities like Atlanta.

- Tennessee: Known for its top-rated healthcare services, Tennessee offers retirees excellent medical facilities at an affordable cost.

If you’re planning to retire in a rural area, ensure that you are within reasonable distance of a medical center. In states like West Virginia and Arkansas, rural healthcare access can sometimes be limited.

💸 Tax Benefits for Retirees in Different States

Tax laws can greatly affect your retirement income. Many states offer tax exemptions on Social Security income, pension income, and other retirement-related benefits. Here’s a breakdown of states offering favorable tax policies for retirees:

- Tennessee: One of the most tax-friendly states, with no state income tax, making it ideal for retirees who rely on retirement income.

- Georgia: Provides a large exemption for retirement income, including Social Security and pensions.

- Mississippi: Offers low taxes and no state income tax on Social Security benefits, which can save retirees a significant amount.

Each state’s approach to property taxes, sales taxes, and inheritance taxes can also impact retirees’ financial plans. Researching each state’s tax policies is crucial to understanding your potential savings in retirement.

🏠 Housing Costs and Affordability for Retirees

Affordable housing is a key factor for many retirees when selecting a state. States with low housing costs and reasonable property taxes are ideal for retirees looking to stretch their retirement savings.

- Mississippi: Known for some of the lowest housing prices in the country, making it a great place for retirees looking for affordable living spaces.

- West Virginia: West Virginia offers affordable housing with low property taxes, contributing to its status as one of the most budget-friendly states for retirees.

- Ohio: With an affordable real estate market, Ohio offers retirees plenty of options for affordable housing in both urban and rural areas.

It’s important to consider both the cost of purchasing a home and ongoing housing expenses like property taxes, homeowner’s insurance, and maintenance costs.

🏘️ Affordable Living for Active Retirees: Best States for Outdoor Activities

If you enjoy outdoor activities like hiking, fishing, or golfing, selecting a state with ample recreational opportunities is key. States like Tennessee, Georgia, and South Carolina offer stunning natural landscapes, making them popular choices for active retirees who want to stay physically engaged.

- Tennessee: Offers beautiful national parks, lakes, and mountain trails perfect for hiking, fishing, and camping.

- South Carolina: Known for its coastal areas and outdoor activities, including golfing, boating, and hiking.

- Georgia: Offers a combination of mountain and coastal regions, providing numerous options for outdoor adventures.

Retirees who value an active lifestyle will find plenty to explore in these states, all while maintaining an affordable cost of living.

❓ Frequently Asked Questions

What is the average cost of living for retirees in these states?

The average cost of living varies by state. For instance, West Virginia and Mississippi have some of the lowest costs, while states like South Carolina and Georgia offer a balance between affordability and amenities.

Are there any states that offer tax exemptions on retirement income?

Yes, several states, including Tennessee, South Carolina, and Georgia, offer tax exemptions on Social Security benefits and other retirement incomes.

How important is healthcare access when choosing a retirement state?

Healthcare access is crucial. States like South Carolina and Georgia have a high number of healthcare facilities, ensuring retirees have access to necessary medical services.

Can I find affordable housing in these states?

Yes, many of these states offer affordable housing options. For example, Mississippi and West Virginia have some of the lowest median home prices in the nation.

What are the climate conditions like in these states?

The climate varies by state. For instance, Tennessee and South Carolina offer mild climates, while states like West Virginia and Ohio experience all four seasons.

🏡 Conclusion

Choosing the right state to retire involves balancing affordability with quality of life. The states listed above offer a combination of low living costs, favorable tax policies, and access to healthcare, making them ideal for retirees. It’s essential to consider personal preferences, such as climate and lifestyle, when making your decision. By thoroughly researching and evaluating these factors, you can find the perfect place to enjoy your retirement years.